The traditional role of a bank was to transfer funds from savers to investors, engaging in maturity transformation, screening for borrower risk and monitoring for borrower effort in doing so. A typical loan contract was set up along six simple dimensions: the amount, the interest rate, the expected credit risk (determining both the probability of default for the loan and the expected loss given default), the required collateral, the currency, and the lending technology. However, the modern banking industry today has a broad scope, offering a range of sophisticated financial products, a wider geography -- including exposure to countries with various currencies, regulation and monetary policy regimes -- and an increased reliance on financial innovation and technology. These new bank business models have had repercussions on the loan contract. In particular, the main components and risks of a loan contract can now be hedged on the market, by means of interest rate swaps, foreign exchangetransactions, credit default swaps and securitization. Securitized loans can often be pledged as collateral, thus facilitating new lending. And the lending technology is evolving from one-to-one meetings between a loan officer and a borrower, at a bank branch, towards potentially disruptive technologies such as peer-to-peer lending, crowd funding or digital wallet services. This book studies the interaction between traditional and modern banking and the economic benefits and costs of this new financial ecosystem, by relying on recent empirical research in banking and finance and exploring the effects of increased financial sophistication on a particular dimension of the loan contract.

The traditional role of a bank was to transfer funds from savers to investors, engaging in maturity transformation, screening for borrower risk and monitoring for borrower effort in doing so. A typical loan contract was set up along six simple dimensions: the amount, the interest rate, the expected credit risk (determining both the probability of default for the loan and the expected loss given default), the required collateral, the currency, and the lending technology. However, the modern banking industry today has a broad scope, offering a range of sophisticated financial products, a wider geography -- including exposure to countries with various currencies, regulation and monetary policy regimes -- and an increased reliance on financial innovation and technology. These new bank business models have had repercussions on the loan contract. In particular, the main components and risks of a loan contract can now be hedged on the market, by means of interest rate swaps, foreign exchange transactions, credit default swaps and securitization. Securitized loans can often be pledged as collateral, thus facilitating new lending. And the lending technology is evolving from one-to-one meetings between a loan officer and a borrower, at a bank branch, towards potentially disruptive technologies such as peer-to-peer lending, crowd funding or digital wallet services.

This book studies the interaction between traditional and modern banking and the economic benefits and costs of this new financial ecosystem, by relying on recent empirical research in banking and finance and exploring the effects of increased financial sophistication on a particular dimension of the loan contract.

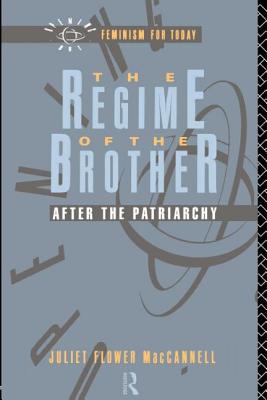

Get Banking and Financial Markets by at the best price and quality guranteed only at Werezi Africa largest book ecommerce store. The book was published by Springer Nature Switzerland AG and it has pages. Enjoy Shopping Best Offers & Deals on books Online from Werezi - Receive at your doorstep - Fast Delivery - Secure mode of Payment

Jacket, Women

Jacket, Women

Woolend Jacket

Woolend Jacket

Western denim

Western denim

Mini Dresss

Mini Dresss

Jacket, Women

Jacket, Women

Woolend Jacket

Woolend Jacket

Western denim

Western denim

Mini Dresss

Mini Dresss

Jacket, Women

Jacket, Women

Woolend Jacket

Woolend Jacket

Western denim

Western denim

Mini Dresss

Mini Dresss

Jacket, Women

Jacket, Women

Woolend Jacket

Woolend Jacket

Western denim

Western denim

Mini Dresss

Mini Dresss

Jacket, Women

Jacket, Women

Woolend Jacket

Woolend Jacket

Western denim

Western denim

Mini Dresss

Mini Dresss